There are 3 ways of defining the finance feature. First off, the finance feature can without a doubt be taken as the project of providing budget wished by way of an agency on favourable phrases, keeping in view the targets of the institute. Which means that the finance feature is purely involved with the purchase (or procurement) of short- term and long-term budget.

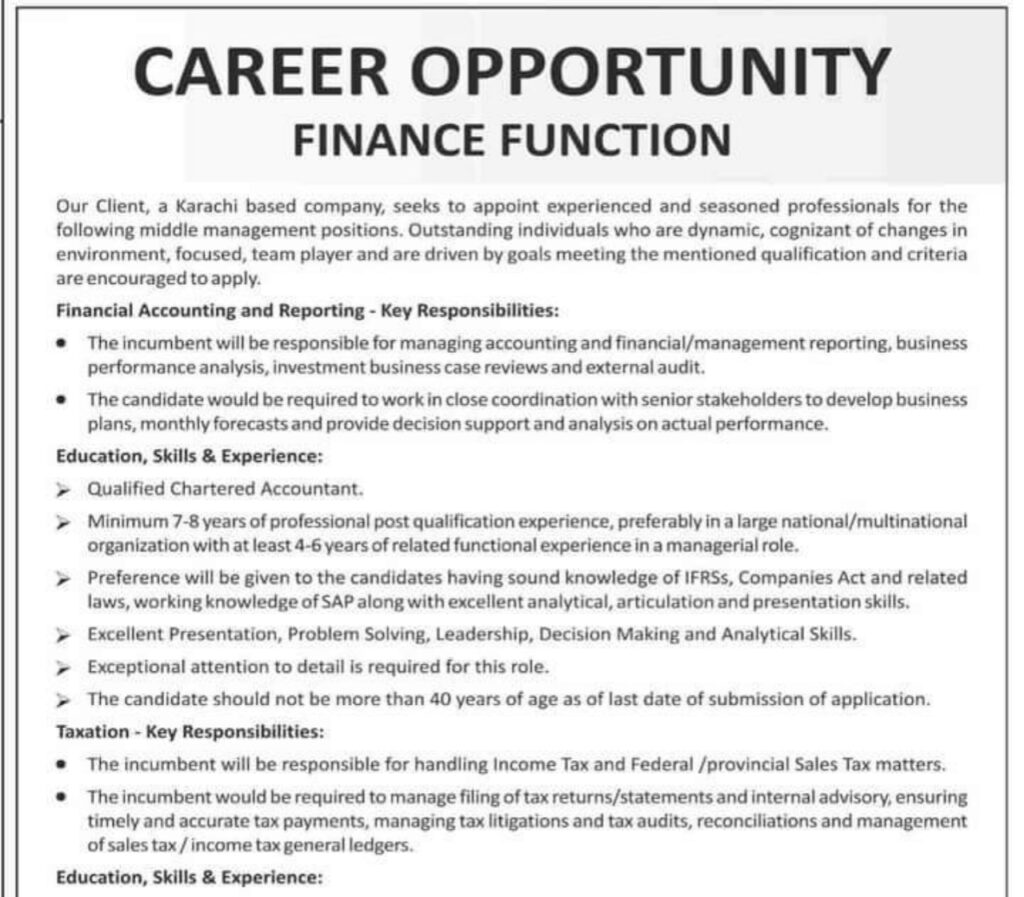

Our Client, a Karachi based company, seeks to appoint experienced and seasoned professionals for the following middle management positions. Outstanding individuals who are dynamic, cognizant of changes in environment, focused, team player and are driven by goals meeting the mentioned qualification and criteria are encouraged to apply.

Post No 1

Caption of post : Financial Accounting and Reporting

Applicant’s Main Responsibilities

- The incumbent will be responsible for managing accounting and financial/management reporting, business Performance analysis, investment business case reviews and external audit.

- The candidate would be required to work in close coordination with senior stakeholders to Plans, monthly forecasts and provide decision support and analysis on actual performance.

Applicant must have following Education, skill and experience :

- Applicant must have qualification of Chartered Accountant.

- Minimum 7 to 8 years of professional post qualification experience, preferably in a large national/multinational institute with at least 4-6 years of related functional experience in a managerial role.

- Preference will be given to the candidates having sound knowledge of IFRSs, Companies Act and related Laws, working knowledge of SAP along with excellent analytical, articulation and presentation skills.

- Excellent Presentation, Problem Solving, Leadership, Decision Making and Analytical skills.

- Exceptional focus to detail is required for this role.

- The interested person should not be more than 40 years of age as of last date of submission of application.

Post No 2

Caption of post : Taxation

Applicant’s Main Responsibilities

- The incumbent will be responsible for handling Income Tax and Federal /provincial Sales Tax matters.

- The incumbent would be required to manage filing of tax returns/statements and internal advisory, ensuring Timely and accurate tax payments, managing tax litigations and tax audits, reconciliations and management Of sales tax/income tax general ledgers.

Applicant must have following Education, skill and experience :

- Applicant must have qualification of Chartered Accountant.

- Minimum 6 to 7 years of professional experience, preferably in a large national/multinational organization with at least 2-5 years of post-qualification experience of working in taxation department of a tax consulting Firm or institution .

- Preference will be given to the candidates having sound knowledge of Tax laws, knowledge of SAP and OMC sector.

- Excellent Presentation, Problem Solving, Leadership, Decision Making and Analytical skills.

- Exceptional focus to detail is required for this role.

- The interested persons should not be more than 35 years of age as of last date of submission of application.

How Applicant can apply for post

If you have the required experience and educational qualification to take up the challenging role you are requested to apply by May 29, 2022 at http://jobs.hrs-int.com/

Only shortlisted candidates will be contacted.